How UK Pensions Are Taxed in Cyprus

A Guide for British Expats

If you're a British expat living in Cyprus, understanding how your UK pension is taxed can help you make smarter financial decisions and avoid unnecessary tax bills. Cyprus is one of the most pension-friendly destinations in Europe, with generous tax treatment for foreign pension income. There's also a tax treaty in place to help you avoid being taxed twice.

In this guide, we explain how UK State Pensions, private pensions, and government pensions are taxed when you become a tax resident in Cyprus.

UK State Pension

✅ Taxed only in Cyprus

❌ Not taxed in the UK

If you receive the UK State Pension while living in Cyprus:

-

You do not pay UK tax on it

-

It is taxed only in Cyprus under the UK-Cyprus Double Taxation Agreement

Cyprus offers two ways to tax foreign pensions:

-

Flat Rate Option: Pay a flat 5% tax on pension income above €3,420 per year

-

Normal Tax Bands: Use Cyprus's progressive tax bands (first €19,500 is tax-free)

You can choose the most tax-efficient option each tax year. Many expats benefit from this flexibility, especially those with lower pension incomes who may pay little to no tax at all.

Tax on UK Private and Workplace Pensions (Including SIPPs)

✅ Also taxed only in Cyprus

❌ No UK tax (as long as the right form is submitted)

UK personal pensions, SIPPs, and most workplace pensions are also:

-

Taxed only in Cyprus, not the UK (as long as you submit HMRC's DT/Individual form)

-

Eligible for the same 5% flat rate or normal income tax bands in Cyprus as for UK State Pension (above). This makes Cyprus particularly attractive for UK retirees drawing income from private pensions.

Tax on UK Government Pensions (e.g. NHS, Military, Civil Service)

✅ Taxed only in the UK

❌ Not taxed in Cyprus

Government pensions are treated differently:

-

They are taxed in the UK, not Cyprus

-

Cyprus will not tax this income again

This includes pensions from employment in the NHS, civil service, police, armed forces, or other UK government bodies.

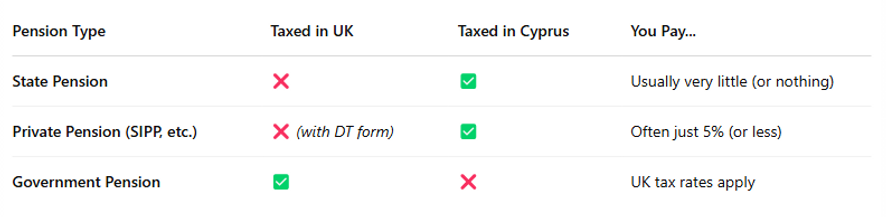

Quick Comparison

Key Benefits for UK Expats in Cyprus

-

No inheritance tax in Cyprus

-

Pensions can be paid into a Cyprus bank account

-

You can switch between the 5% flat rate and normal tax bands each tax year, depending on your income

To benefit fully, you must be a tax resident of Cyprus (typically by spending more than 183 days per year there, or qualifying under the 60-day rule).

Need Help Managing Your UK Pensions?

At MF Investment Advice, we help British expats in Cyprus make the most of their pensions and retirement income. Whether you need help submitting tax forms, reviewing your pension strategy, or planning your legacy, we're here to help.

Get in touch today to speak with an advisor who understands both UK and Cyprus pension rules.